Our Process

It is our goal to provide comprehensive financial management services to our clients.

The first step in this endeavor is to compile a thorough profile of the client in order to have an accurate measure of their future goals and what they want to achieve. Our recommendations will be based on the client’s goals, risk tolerance and the time factor.

Periodically these factors will be reviewed to determine the suitability of our initial recommendation in respect to the original goals and any new objectives that may have arisen.

The following process is a reflection of our business model, designed to enhance client's experience.

Step 1: Introduction and Discovery (fact finding in order to gain a good understanding of where you are and where you want to go).

Step 2: Planning (planning meetings consist of several meetings depending on the complexity of your situation).

Step 3: Implementation Phase (executing your investment plan using various financial products and services).

Step 4: Ongoing Reviews (first review meeting is scheduled 45 to 90 days after the last planning meeting and then review meetings are conducted annually).

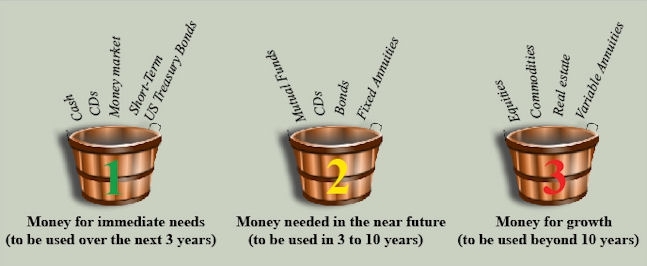

Time diversification strategy in retirement planning

Our approach to effective retirement planning incorporates “time diversification” strategy. This simply means “bucketing” retirement savings into different types of assets to account for the timing of withdrawals.

Money for immediate needs (bucket No. 1). Dollars held in cash or cash-equivalent investments where principal is secure. This should be a sufficient amount to cover retirement expenses over the next one to three years.

Money needed in the near future (bucket No. 2). Assets that will be tapped for expenses in the subsequent three to ten years can be devoted to low- or no-volatility investments.

Money for growth (bucket No. 3). Most of the portfolio can still be allocated among a diversified mix of assets, including equities, to achieve growth that will allow future distributions to keep pace with inflation. Because this money will not be required to meet income needs for several years, sequence risk is significantly reduced.

In strong markets, clients can choose to start distributions or make selected asset sales and move the proceeds to buckets No. 1 and No. 2. If markets are down, they can delay distributions or asset sales temporarily, as long as the first two buckets have sufficient assets.